Credit Default Swap (CDS) Market Size to Worth USD 15,741.14 billion by 2034 | CAGR of 6.5% during 2026-2034

Global credit default swap (CDS) market poised to grow from USD 8,963.40 billion in 2025 to USD 15,741.14 billion by 2034 at a CAGR of 6.5%

NEW YORK, NY, UNITED STATES, February 5, 2026 /EINPresswire.com/ -- The global credit default swap (CDS) market size was valued at USD 8,963.40 billion in 2025. The market is projected to grow from USD 9,513.07 billion in 2026 to USD 15,741.14 billion by 2034, exhibiting a CAGR of 6.5% during the forecast period. The credit default swap (CDS) market is a key segment of the global derivatives market, enabling investors to hedge or transfer credit risk associated with corporate and sovereign debt. CDS contracts function as insurance-like instruments against default events, widely used by banks, hedge funds, institutional investors, and asset managers. Despite increased regulation following the global financial crisis, the CDS market remains vital for risk management, price discovery, and credit market liquidity.Get a Free Sample of this Report: https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/credit-default-swap-cds-market-115243

Key Market Insights

Financial institutions remain the primary participants in the credit default swap (CDS) market, using these instruments extensively for risk management, hedging, and speculative purposes. Sovereign and corporate CDS contracts dominate overall trading volumes, reflecting strong demand for protection against government and corporate credit risk. CDS spreads are closely linked to bond yields and broader macroeconomic conditions, making them key indicators of market sentiment and creditworthiness. Changes in interest rates, economic growth, and geopolitical developments are often quickly reflected in CDS pricing. In recent years, enhanced regulatory oversight and reporting requirements have improved market transparency and standardization. These measures have also helped reduce counterparty and systemic risk, strengthening overall market stability and investor confidence.

Market Trends

The credit default swap market is witnessing increased use of central clearing counterparties (CCPs) for CDS transactions, which is enhancing counterparty risk management and overall market stability. There is also growing demand for CDS as an effective hedge against economic uncertainty, market volatility, and geopolitical risks, particularly during periods of financial stress. Market participants are increasingly favoring CDS indices over single-name CDS, as indices offer broader exposure and more efficient portfolio-level risk management. In addition, the integration of advanced analytics, data-driven risk assessment tools, and electronic trading platforms is improving price discovery, liquidity, and execution efficiency. These developments are contributing to greater transparency and accessibility within the CDS market.

Market Growth Factors

Rising volatility across global financial and credit markets is significantly increasing demand for instruments that help manage and mitigate credit risk more effectively. As economic uncertainty, interest rate fluctuations, and geopolitical tensions intensify, financial institutions, asset managers, and investors are increasingly relying on robust credit risk management tools to protect portfolios and stabilize returns. The continued growth in sovereign debt issuance across both emerging and developed economies is further accelerating the use of credit default swaps, as market participants seek efficient hedging mechanisms against government default risk. Moreover, the expansion of institutional investment, along with the rising complexity of structured and leveraged debt instruments, is adding layers of risk to global portfolios. This evolving market environment is reinforcing the importance of sophisticated risk-transfer solutions such as CDS, which support portfolio diversification, capital efficiency, and proactive credit risk control strategies.

Segmentation Analysis

By Type:

• Single-Name CDS

• CDS Index

By Reference Entity:

• Corporate

• Sovereign

• Financial Institutions

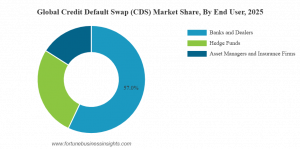

By End User:

• Banks & Financial Institutions

• Hedge Funds

• Asset Managers

• Insurance Companies

• Others

By Trading Platform:

• Over-the-Counter (OTC)

• Exchange-Traded / Centrally Cleared

Speak to Analyst: https://www.fortunebusinessinsights.com/enquiry/speak-to-analyst/credit-default-swap-cds-market-115243

Regional Analysis

North America dominates the credit default swap market, supported by the presence of major financial institutions, highly active credit markets, and well-established regulatory frameworks that promote transparency and liquidity. Europe holds a significant market share, driven by strong sovereign CDS trading activity and extensive participation from global and regional banks managing cross-border credit exposures. The Asia Pacific region is experiencing steady growth, fueled by expanding corporate debt markets, increasing capital market sophistication, and the rising adoption of credit risk management instruments by financial institutions. Meanwhile, Latin America and the Middle East & Africa are witnessing moderate growth, supported by developing financial markets and a gradual increase in sovereign and corporate CDS usage to hedge credit risk.

Key Industry Players

• JPMorgan Chase & Co. (U.S.)

• Goldman Sachs Group (U.S.)

• Morgan Stanley (U.S.)

• Citigroup (U.S.)

• Bank of America (U.S.)

• Barclays (U.K.)

• Deutsche Bank (Germany)

• BNP Paribas (France)

• UBS (Switzerland)

• HSBC (U.K.)

• Credit Suisse (legacy positions integrated into UBS) (Switzerland)

• Société Générale (France)

• Nomura (Japan)

• Wells Fargo (U.S.)

• Standard Chartered (U.K.)

Key Industry Developments

• November 2025: FICO partnered with Plaid to deliver the next generation of the cash flow UltraFICO Score. This innovative solution will combine the proven reliability of the FICO Score, used by 90% of top US lenders, with real-time cash-flow data from Plaid to provide lenders with a single, enhanced credit score.

• October 2025: Barclays announced the signing of a new multi-year strategic agreement with SIX, the global financial data and market infrastructure provider. The multi-year collaboration will help in spanning investment banking, retail banking, wealth management, and corporate services.

Future Outlook

The credit default swap market is expected to remain an essential component of the global financial system, supported by sustained demand for effective credit risk hedging and portfolio diversification strategies. Financial institutions, asset managers, and institutional investors continue to rely on CDS instruments to manage exposure to corporate and sovereign credit risk amid evolving market conditions. Although regulatory scrutiny will continue to influence market structure and trading practices, it is also contributing to greater transparency, standardization, and reduced systemic risk. Advancements in central clearing, reporting frameworks, and electronic trading platforms are improving market efficiency, liquidity, and price discovery. In parallel, the integration of advanced analytics and real-time risk assessment tools is strengthening decision-making. Collectively, these developments are enhancing market resilience and are expected to support stable and sustainable long-term growth.

Read Related Insights:

BFSI Crisis Management Market

BFSI Security Market

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.