Europe Plastics Market Size to Cross USD 223.02 Billion by 2034

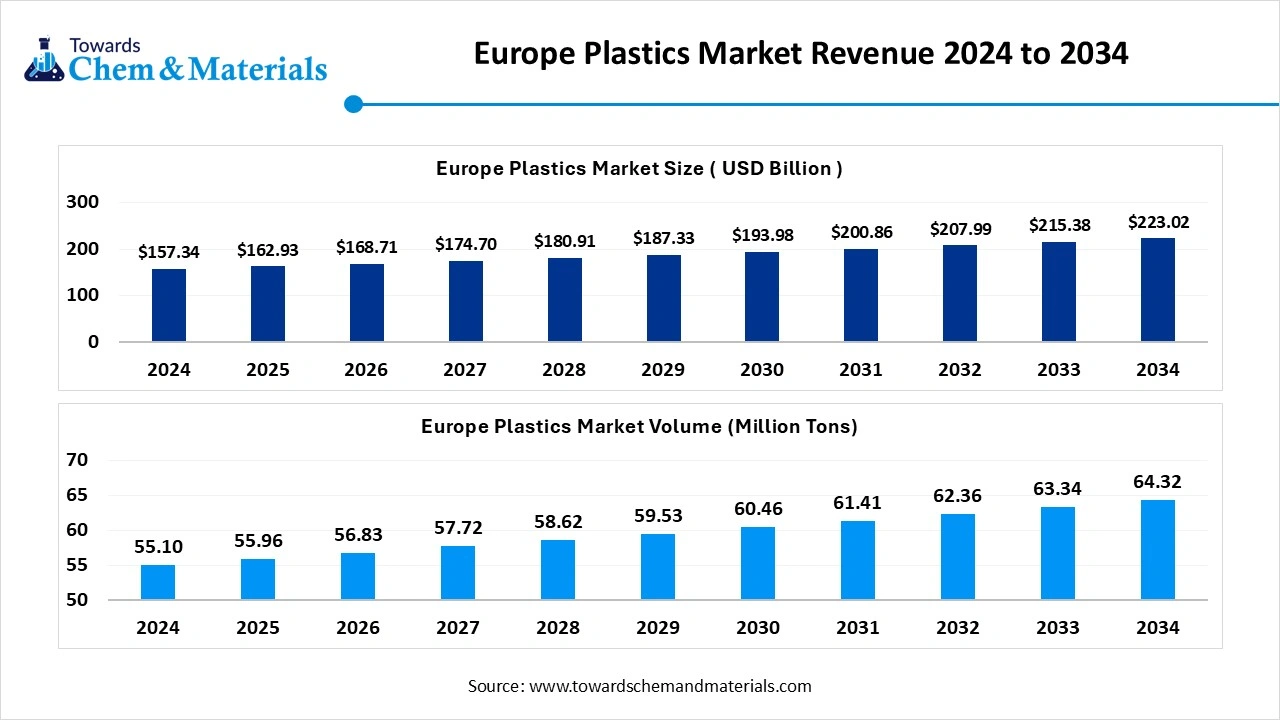

According to Towards Chemical and Materials, the Europe plastics market size is calculated at USD 162.93 billion in 2025 and is expected to be worth around USD 223.02 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.55% over the forecast period 2025 to 2034.

Ottawa, Oct. 10, 2025 (GLOBE NEWSWIRE) -- The Europe plastics market size was valued at USD 157.34 billion in 2024 and is anticipated to reach around USD 223.02 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.55% over the forecast period from 2025 to 2034. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

The key growth factor for the market is the rising demand for lightweight and durable materials in the automotive and packaging industries.

According to Towards Chemical and Materials, the Europe plastics market is experiencing rapid growth, with volumes expected to increase from 55.96 million tons in 2025 to 64.32 million tons by 2034, representing a robust CAGR of 1.56 % over the forecast period.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5707

Europe Plastics Overview

The Europe plastics market is shaped by evolving environmental policies, growing demand for sustainable materials, and innovations in recycling and bio-based plastics. Stringent regulatory frameworks across many European countries are pushing manufacturers to adopt circular economy principles while consumer preference is titling toward eco-friendly plastics. The market spans diverse end-use sectors from packaging and automotive to healthcare and construction, and sees rising momentum in advanced technologies and materials such as high performance polymers and bioplastics. Continuous investment in research and development, together with expansion of advanced sorting and chemical recycling infrastructure, is reinforcing resilience and transformation in the European plastics landscape.

Europe Plastics Market Report Highlights

- By region, Western Europe dominated the Europe plastics market with a 45% market share in 2024. The dominance of the region can be attributed to the ongoing environmental regulations and increasing consumer awareness.

- By resin type, the polypropylene (PP) segment held a 22% market share in 2024. The dominance of the segment can be attributed to the rising product demand in the automotive, packaging, and construction industries.

- By technology, the injection molding segment led the market with a 35% market share in 2024. The dominance of the segment can be linked to the ongoing advancements in molding technology.

- By application, the packaging segment dominated the market by holding 40% market share in 2024. The dominance of the segment is owed to the surge in the e-commerce sector and the rising need for convenience packaging.

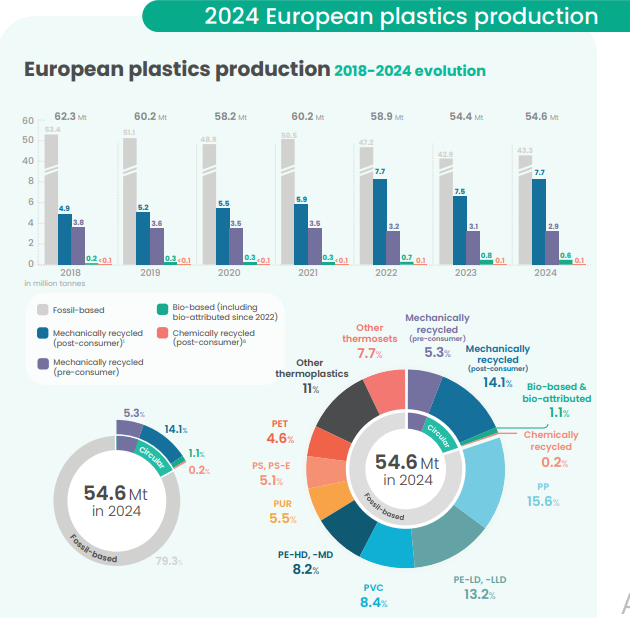

- By material origin, the fossil-based plastics segment led the market with 88% market share in 2024. The dominance of the segment can be linked to the robust global demand for plastics and established infrastructure.

- By functionality, the thermoplastics segment held an 80% market share in 2024. The dominance of the segment can be attributed to the increasing use of thermoplastics in automobiles.

Buy Now this Premium Research Report at a Special Price Against the List Price With [Express Delivery] @ https://www.towardschemandmaterials.com/checkout/5707

Europe Plastics Market Report Scope

| Report Attribute | Details |

| Market size value in 2026 | USD 168.71 billion |

| Revenue forecast in 2034 | USD 223.02 billion |

| Growth rate | CAGR of 3.55% from 2025 to 2034 |

| Historical data | 2021 - 2024 |

| Forecast period | 2025 - 2034 |

| Quantitative units | Revenue in USD million/billion, volume in tons, and CAGR from 2025 to 2034 |

| Report coverage | Revenue forecast, competitive landscape, growth factors, and trends |

| Report Segmentation | By Resin Type, By Technology, By Application, By Material Origin, By Functionality, By Region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Country scope | U.S.; Canada; Mexico; Germany; Austria; UK; France; Spain; Italy; Netherlands; Belgium; China; Australia; South Korea; Southeast Asia; India; Japan; Brazil; Argentina; Saudi Arabia; South Africa |

| Key companies profiled | BASF SE (Germany), LyondellBasell Industries (Netherlands), INEOS Group (UK), Borealis AG (Austria), SABIC Europe (Netherlands), Covestro AG (Germany), Arkema S.A. (France), TotalEnergies Polymers (France), Repsol S.A. (Spain), Evonik Industries AG (Germany), LANXESS AG (Germany), Röchling Group (Germany), Ensinger GmbH (Germany), Solvay S.A. (Belgium), Celanese Europe BV (Germany), DSM Engineering Materials (Netherlands), ExxonMobil Chemical Europe, Versalis (Italy – subsidiary of Eni), MOL Group (Hungary), Plásticos Compuestos S.A. (Spain) |

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Here Are Some Top Products In The Europe Plastics Market

- Polyethylene (PE)- Widely used in packaging (films, bottles), household goods, and agriculture.

- Polypropylene (PP)- Used in automotive parts, packaging, textiles, and consumer products.

- Polyvinyl Chloride (PVC)- Common in construction (pipes, windows), healthcare, and electrical applications.

- Polystyrene (PS)- Used in packaging, insulation, disposable cutlery, and consumer electronics.

- Polyethylene Terephthalate (PET)- Popular for beverage bottles, food packaging, and textiles.

- Polyurethane (PU)- Used in insulation, furniture, automotive seating, and footwear.

- Polyamide (PA/Nylon)- Found in automotive components, textiles, and engineering plastics.

- Acrylonitrile Butadiene Styrene (ABS)- Used in automotive, electronics, and household appliances.

- Polymethyl Methacrylate (PMMA)- Transparent plastic used in displays, lighting, and automotive parts.

- Bioplastics- Emerging segment used in packaging, agriculture, and disposable items with lower CO₂ impact.

What Are The Major Trends In The Europe Plastics Market?

- Growing emphasis on environmental regulations and circular economy model is pushing industry players toward recycling, chemical recycling and sustainable feedstock’s.

- Rising demand for bioplastics and bio-based resins is reshaping product portfolios, driven by consumer preference and legislative pressure to reduce plastic waste.

- Technological advancements in sorting, recycling, and additive manufacturing are enabling higher efficiency, better quality plastics, and more versatile applications.

- Packaging remains a key application area, socially with growth in e-commerce and flexible packaging formats that require lighter, more adaptable materials.

- Material functionality is shifting toward high-performance and specialty plastics, which offer superior mechanical, thermal or chemical properties that support lighter weight, durability, or specialized performance needs.

How Does AI Influence The Growth Of The Europe Plastics Market In 2025?

In 2025, AI is accelerating the evolution of the Europe plastics market by enabling smarter, more efficient production and recycling workflows. For example, AI driven tools are being deployed to assess and optimize packaging designs for recyclability while minimizing material use. In recycling operations, deep-learning models and robotic sorting systems are improving purity of recovered plastics by distinguishing between resin types and filtering contaminants more accurately. Within manufacturing plants, AI is being used for predictive maintenance, process control, and digital twins, which helps reduce downtime and scrap and boosts throughput. Moreover, AI innovations are surfacing more frequently in patent fillings in Europe’s plastics waste and recycling space, singling a push toward technology led sustainability. Together these shifts are reinforcing circular economy strategies and enabling the plastics industry in Europe to better respond to regulatory, environmental, and cost pressures.

Europe Plastics Market Dynamics

Growth Factors

Is Recycled Feedstock Reshaping Plastics Production?

Companies in Europe are increasingly integrating recycled feedstock into their polymer manufacturing. For example, on major producer in France has started using pyrolysis oil derived from plastic waste to make new polymers, helping products meet tougher recycled content rules. This move lowers resilience on virgin fossil feedstock and helps align production with circular economy goals. It also encourages investment across the supply chain into sorting, purification, and chemical recycling infrastructure.

Are Biomass Based And Bio Derived Plastics Gaining Traction?

The plastics industry is exploring biomass sources beyond traditional crops, such as agricultural residues, for bioplastics production. That trend supports reducing dependency on fossil feedstock and meeting sustainability targets. It spurs research and development in novel feedstock’s and alternative polymers compatible with existing processing systems.

Market Opportunity

Could Decentralized Recycling Unlock New Market Access?

Deploying portable, AI powered robotic recycling units in remote or underserved areas is opening access to waste streams that were preciously uneconomical to process. For instance, a consortium in Europe has introduced low-cost, portable recycling plants designed to recover materials closer to the source. This approach reduces transportation costs, lowers carbon footprint, and can stimulate local circular economies. It also allows manufacturers to source recycled feedstock from regions previously off the grid.

Might Upcycling Waste By-Products Into Bioplastics Be The Next Frontier?

Dome European projects are converting agricultural or industrial residues into high performance bioplastics, turning waste into value. The LIFE RESTART initiative, for example, uses beer industry waste to develop bioplastic alternatives to fossil derived polymers. Such transformations help firms meet regulatory pressure for circularity and open new revenue streams. They also foster partnerships across sectors from agriculture to plastics to scale sustainable material innovation.

Limitations In The Europe Plastics Market

- Dependence on virgin fossil feedstocks remains strong in many European plastics supply chains, making it difficult to shift rapidly toward more sustainable or bio-based alternatives.

- Import of recycled plastics from outside the EU undermines the competitiveness of local recycled material producers, specially when quality issues or contaminant laden content limit use in regulated or high value applications.

Europe Plastics Market Segmentation Insights

Resin Type Insights

Which Resin Type Is Dominating The Europe Plastics Market?

Propylene (PP) segment emerged as the dominant resin type in the Europe plastics market, holding a significant market share. The widespread use of PP across various applications, including automotive components, packaging materials, and consumer goods, has contributed to its market leadership. PP’s versatility, cost-effectiveness, and recyclability make it a preferred choice among manufacturers aiming to meet both performance and sustainability criteria. Additionally, advancements in PP production technologies have led to improved material properties, further boosting its adoption in diverse industries. As a result, PP continues to maintain a leading position in the market, catering to the growing demand for high quality and eco-friendly plastic products.

Polylactic Acid (PLA) segment is anticipated to experience the fastest growth in the Europe plastics market during the forecast period. PLA’s biodegradable nature and its origin from renewable resources align with the increasing consumer and regulatory demand for sustainable materials. Industries such as packaging, textiles, and agriculture are increasingly adopting PLA due to its environmental benefits and compatibility with existing processing technologies. The European Union’s stringent regulations on plastic waste and the emphasis on circular economy practices are further accelerating the adoption of PLA based products. As technological advancements continue to enhance PLA’s performance and cost-effectiveness, its market share is expected to expand rapidly in the coming years.

Technology Insights

Which Technology Is Dominating The Europe Plastics Market?

Injection molding segment dominated the Europe plastics market in 2024, owing to its efficiency, precision , and versatility in producing complex plastic parts. This technology is widely utilized across various industries, including automotive, consumer electronics, and mechanical devices, for manufacturing components that require high dimensional accuracy and consistency. The continuous advancements in injection molding technologies, such as multi-material molding and micro-molding, have further enhanced its capabilities, allowing for the production of intricate designs and the integration of multiple materials in a single process. Additionally, the growing emphasis on recycling and the use of recycled materials in injection molding processes have contributed to its sustained dominance in the market.

3D printing segment is experiencing the fastest growth in the market during the forecast period. The ability to produce complex and customized plastic parts with reduced material waste has made 3D printing increasingly popular across industries such as aerospace, healthcare, and automotive. Advancements in 3D printing materials and technologies have expanded its applications, enabling the production of functional prototypes, end-use parts, and tooling. The European Union’s support for innovation and sustainable manufacturing practices has further accelerated the adoption of 3D printing technologies. As industries continue to seek more efficient and flexible manufacturing solutions, 3D printing is posed to play a significant role in the future of the market.

Application Insights

Which Application Is Dominating The Europe Plastics Market?

Packaging stands segment dominated the market in 2024, driven by the growing demand for convenient, lightweight, and protective packaging solutions across various industries. The rise of e-commerce and the increasing need for food safety and preservation have further fuelled the demand for plastic packaging materials. Plastic’s versatility, cost-effectiveness, and ability to be moulded into various shapes and sizes make it an ideal choice for packaging applications. Moreover, the industry’s focus on sustainability has led to innovations in recyclable and biodegradable packaging materials, ensuring that packaging continues to meet both functional and environmental requirements. As a result, packaging remains the leading application segment in the market, carting to the evolving needs of consumers and industries alike.

The healthcare and medical segment is experiencing the fastest growth in the Europe plastics market during the forecast period. The increasing gaining population, advancements in medical technologies, and heightened health awareness are driving the demand for plastic products in medical devices, diagnostics, and pharmaceuticals packaging. Plastics offer advantages such as sterilizability, lightweight, and cost effectiveness, making them suitable for a wide range of medical applications. The European Union’s regulatory frameworks ensure the safety and quality of medical grade plastics, further boosting their adoption in the healthcare sector. As the healthcare industry continues to expand and innovate, the demand for specialized plastic products is expected to grow rapidly, positioning this application segment as a key driver in the market.

Material Origin Insights

Which Material Origin Is Dominating The Europe Plastics Market?

Fossil based plastics segment dominate the Europe plastics market in 2024, accounting for a significant share due to their established production processes, widespread availability, and cost effectiveness. These materials are extensively used across various applications, including packaging, automotive, and construction, owing to their desirable properties such as durability, flexibility, and ease of processing. The well-developed infrastructure and supply chains associated with fossil based plastics further reinforce their dominance in the market. However, the increasing emphasis on sustainability and the European Union’s regulations on plastic waste are driving the industry to explore alternative material’s and recycling methods. Despite these challenges, fossil based plastics remain the predominant material origin in the market.

Bioplastics segment experiencing the fastest growth in the Europe plastics market during the forecast period, driven by the increasing consumer demand for sustainable and eco-friendly products. Bioplastics, derived from renewable resources such as plant stenches and sugars, offer a reduced environmental footprint compared to traditional fossil based plastics. The European Union’s initiates to promote a circular economy and reduce plastic waste further accelerated the adoption of bioplastics in various applications, including packaging, agriculture, and consumer goods. Advancements in bioplastic production technologies and the development of new biopolymer materials are expanding the potential applications of bioplastics, contributing to their rapid growth in the market.

Functionality Insights

Which Functionality Is Dominating The Europe Plastics Market?

Thermoplastics segment dominate the Europe plastics market in 2024 due to their versatility, ease of processing, and recyclability, these materials can be melted and re-modelled multiple times without significant degradation, making them suitable for a wide range of application, including automotive parts, consumer goods, and packaging. The ability to recycle thermoplastics aligns with the European Union’s sustainability goals and circular economy initiatives, further boosting their adoption. Advancements in thermoplastics materials, such as the development of high performance grades, have expanded their use in demanding applications, including electronics and medical devices. As a result, thermoplastics continue to hold a dominant position in the market, offering a balance between performance and environmental considerations.

High performance plastics segment experiencing the fastest growth in the market during the forecast period, driven by the increasing demand for materials that offer superior mechanical, thermal, and chemical properties. These advanced plastics are essential in applications such as aerospace, automotive, electronics, and medical devices, where performance plastics in various industries. Additionally, the emphasis on lightweight materials to improve energy efficiency and reduce emissions is further propelling the growth of high performance standards, high performance plastics are poised to play a significant role in the future of the market.

By Country Insights

Which Region Dominates the Europe Plastics Market?

Western Europe dominates the Europe plastics market in 2024 owing to its strong industrial base, advanced processing technologies, and high demand across packaging, automotive, and construction applications. The region benefits from well-established recycling systems and strict regulatory frameworks that encourage the use of sustainable materials, driving innovation in both bio-based and recycled plastics. Western Europe is also home to major chemical and polymer producers that invest heavily in research and development, further reinforcing its leading position. In addition, the integration of circular economy practices is more advanced here compared to other regions, giving Western Europe a decisive edge in shaping the future of plastics in Europe.

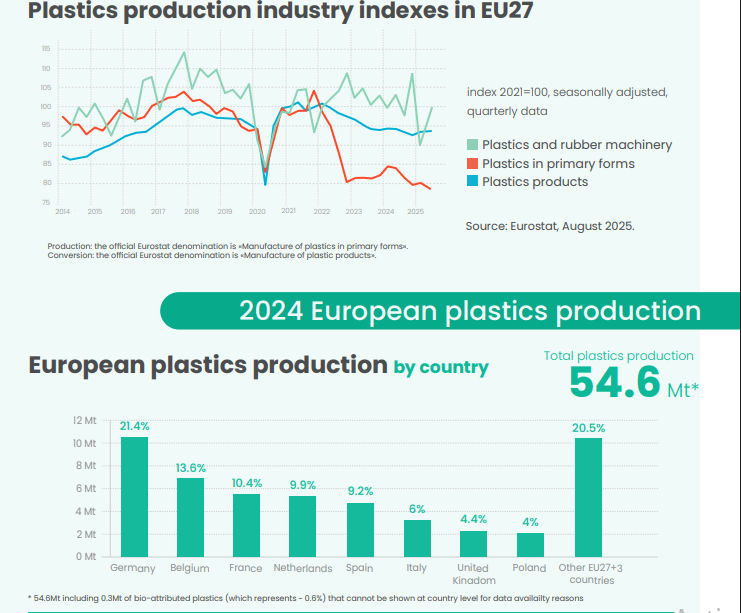

Germany plays a pivotal role in the market as one of the continent’s largest producers and consumers, supported by its robust manufacturing sector and emphasis on engineering excellence. The country’s automotive industry, in particular, drives demand for lightweight and durable plastics, while its packaging sector continues to evolve with innovative solutions that align with sustainability goals. Germany also invests significantly in recycling and circular economy initiatives, making it a leader in adopting sustainable practices. Moreover, the presence of global chemical companies, research institutions, and trade fair strengthens Germany’s influence on trends and developments across Europe’s plastics market. This makes Germany not only a key consumer but also a driver of technological and sustainability shifts in the industry.

Which Region Is Experiencing The Fastest Growth In The Europe Plastics Market?

Eastern Europe is emerging as the fastest growing region in the Europe plastics market, driven by rapid urbanization, expanding infrastructure development, and increasing demand for recycled plastics in textiles, packaging, and automotive industries. This growth is also fuelled by the region’s rising environmental consciousness and the adoption of circular economy principles. The shift towards sustainable practices is promoting investments in recycling technologies and the use of recycled PET, particularly in the textile sectors. Additionally, Eastern Europe’s competitive labour costs and favourable policies are attracting foreign investments, further accelerating market expansion.

Europe Plastics Market Top Companies

- BASF SE (Germany)- Major producer of engineering plastics, polyurethane, and performance materials with strong R&D capabilities.

- LyondellBasell Industries (Netherlands)- Key supplier of polypropylene and polyethylene; operates large-scale polymer plants in Europe.

- INEOS Group (UK)- Leading in olefins and polyolefins; significant investment in recycling and circular economy solutions.

- Borealis AG (Austria)- Specializes in polyolefins and plastic innovation for infrastructure and packaging.

- SABIC Europe (Netherlands)- Supplies advanced thermoplastics and sustainable polymer solutions across automotive and packaging sectors.

- Covestro AG (Germany)- Produces polycarbonates and polyurethane used in automotive and electronics industries.

- Arkema S.A. (France)- Develops specialty polymers and bio-based plastics; focused on innovation and sustainability.

- TotalEnergies Polymers (France)- Manufactures a wide range of polymers, emphasizing low-carbon and recyclable materials.

- Repsol S.A. (Spain)- Supplies polyolefins and invests in circular plastics and chemical recycling technologies.

- Evonik Industries AG (Germany)- Produces high-performance polymers used in medical, automotive, and 3D printing sectors.

More Insights in Towards Chemical and Materials:

- Plastics Market ; The global plastics market size was reached at USD 651.55 billion in 2024 and is expected to be worth around USD 984.11 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.21% over the forecast period 2025 to 2034.

- Recycled Plastics Market : The global recycled plastics market size was reached at USD 83.19 billion in 2024 and is expected to be worth around USD 183.80 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.25% over the forecast period 2025 to 2034.

- Mechanical Recycling of Plastics Market : The global mechanical recycling of plastics market size was reached at USD 37.85 billion in 2024 and is expected to be worth around USD 92.86 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.39% over the forecast period 2025 to 2034.

- Sustainable Plastics Market ; The global sustainable plastics market size was valued at USD 410.73 billion in 2024, grew to USD 465.89 billion in 2025, and is expected to hit around USD 1,448.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 13.43% over the forecast period from 2025 to 2034.

- Recycled Plastic Pipes Market : The global recycled plastic pipes market size was approximately USD 7.85 billion in 2024 and is projected to reach around USD 20.08 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 9.85% between 2025 and 2034.

- Carbon Fiber Reinforced Plastic (CFRP) Market : The global carbon fiber reinforced plastic (CFRP) market size was approximately USD 19.85 billion in 2024 and is projected to reach around USD 48.08 billion by 2034, with an estimated compound annual growth rate (CAGR) of about 9.25% between 2025 and 2034

- Commodity Plastics Market ; The global commodity plastics-market size was valued at USD 498.55 billion in 2024, grew to USD 513.26 billion in 2025, and is expected to hit around USD 666.76 billion by 2034, growing at a compound annual growth rate (CAGR) of 2.95% over the forecast period from 2025 to 2034.

- U.S. Biodegradable Plastics Market : The U.S. biodegradable plastics market size is calculated at USD 2.14 billion in 2024, grew to USD 2.34 billion in 2025, and is projected to reach around USD 5.27 billion by 2034. The market is expanding at a CAGR of 9.44% between 2025 and 2034.

- U.S. Plastic Compounding Market : The U.S. plastic compounding market size was reached at USD 11.19 billion in 2024 and is expected to be worth around USD 22.96 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.45% over the forecast period 2025 to 2034.

- Recycled Plastics In Green Building Materials Market : The global recycled plastics in green building materials market size was reached at USD 5.31 billion in 2024 and is expected to be worth around USD 12.24 billion by 2034, growing at a compound annual growth rate (CAGR) of 8.71% over the forecast period 2025 to 2034.

- Plastic Injection Molding Market : The global plastic injection molding market size accounted for USD 12.45 billion in 2024 and is predicted to increase from USD 12.89 billion in 2025 to approximately USD 17.65 billion by 2034, expanding at a CAGR of 3.55% from 2025 to 2034.

- Corrugated Plastic Sheets Market : The global corrugated plastic sheets market size was valued at USD 1.85 billion in 2024, grew to USD 1.95 billion in 2025, and is expected to hit around USD 3.05 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.14% over the forecast period from 2025 to 2034.

- Plastic Compounding Market : The global plastic compounding market size was reached at USD 72.55 billion in 2024 and is expected to be worth around USD 148.83 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.45% over the forecast period 2025 to 2034.

- Biodegradable Plastics Market : The global biodegradable plastics market size was reached at USD 13.19 billion in 2024 and is expected to be worth around USD 91.26 billion by 2034, growing at a compound annual growth rate (CAGR) of 21.34% over the forecast period 2025 to 2034.

- Microplastic Recycling Market : The global microplastic recycling market size was reached at USD 325.19 million in 2024 and is expected to be worth around USD 817.00 million by 2034, growing at a compound annual growth rate (CAGR) of 9.65% over the forecast period 2025 to 2034.

- U.S. Plastics Market ; The U.S. plastics market size was reached at USD 92.66 billion in 2024 and is expected to be worth around USD 131.34 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.55% over the forecast period 2025 to 2034.

- Plastic Lidding Films Market : The global plastic lidding films market size was reached at USD 3.33 billion in 2024 and is expected to be worth around USD 5.13 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.42% over the forecast period 2025 to 2034.

- U.S. Recycled Plastics Market : The U.S. recycled plastics market size was reached at USD 52.85 billion in 2024 and is expected to be worth around USD 131.33 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.53% over the forecast period 2025 to 2034.

Europe Plastics Market Top Key Companies:

- BASF SE (Germany)

- LyondellBasell Industries (Netherlands)

- INEOS Group (UK)

- Borealis AG (Austria)

- SABIC Europe (Netherlands)

- Covestro AG (Germany)

- Arkema S.A. (France)

- TotalEnergies Polymers (France)

- Repsol S.A. (Spain)

- Evonik Industries AG (Germany)

- LANXESS AG (Germany)

- Röchling Group (Germany)

- Ensinger GmbH (Germany)

- Solvay S.A. (Belgium)

- Celanese Europe BV (Germany)

- DSM Engineering Materials (Netherlands)

- ExxonMobil Chemical Europe

- Versalis (Italy – subsidiary of Eni)

- MOL Group (Hungary)

- Plásticos Compuestos S.A. (Spain)

Recent Developments

- In June 2025, EU member states have backed a proposal to require a minimum recycled plastic content in new vehicles, pushing automakers toward more sustainable materials. This regulation aims to reduce waste and reliance on virgin plastics.

- In August 2025, talks in Geneva aimed at finalizing a legally binding treaty on plastic pollution ended without agreement, leaving key issues on production limits and waste treatment unresolved.

Europe Plastics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chemical and Materials has segmented the global Europe Plastics Market

By Resin Type (Volume, Kilotons; Revenue, USD Million, 2021 - 2034)

- Polyethylene (PE)

- HDPE

- LDPE

- LLDPE

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- General Purpose PS

- High Impact PS

- Polyethylene Terephthalate (PET)

- Polycarbonate (PC)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyamide (PA)

- Polylactic Acid (PLA)

- Polyurethane (PU)

- Others (POM, PPS, PBT, etc.)

By Technology (Volume, Kilotons; Revenue, USD Million, 2021 - 2034)

- Injection Molding

- Blow Molding

- Extrusion

- Thermoforming

- Compression Molding

- Rotational Molding

- 3D Printing/Additive Manufacturing

By Application (Volume, Kilotons; Revenue, USD Million, 2021 - 2034)

- Packaging

- Rigid Packaging

- Flexible Packaging

- Automotive & Transportation

- Interior Components

- Exterior Components

- Under-the-hood Applications

- Construction

- Pipes & Fittings

- Insulation

- Roofing & Cladding

- Electrical & Electronics

- Casing & Enclosures

- Connectors & Housings

- Healthcare & Medical

- Disposables

- Medical Devices

- Drug Delivery Systems

- Consumer Goods

- Household Goods

- Sports & Leisure Products

- Agriculture

- Mulch Films

- Greenhouse Films

- Irrigation Components

- Industrial Machinery

- Textiles (Technical textiles, fibers)

By Material Origin (Volume, Kilotons; Revenue, USD Million, 2021 - 2034)

- Fossil-based Plastics

- Bioplastics

- Bio-based (drop-in bio PET, bio PE)

- Biodegradable (PLA, PHA, PBS)

By Functionality (Volume, Kilotons; Revenue, USD Million, 2021 - 2034)

- Thermoplastics

- Thermosets

- Engineering Plastics

- High-performance Plastics

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5707

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.